Editorial Note: Intuit Credit Karma receives compensation from third-party advertisers, but that doesn’t affect our editors’ opinions. Our third-party advertisers don’t review, approve, or endorse our editorial content. Information about financial products not offered on Credit Karma is collected independently. Our content is accurate to the best of our knowledge when posted.

How to save money Saving money can help create a sense of stability and control over your finances, especially as you get older. From being able to invest in your future to spotting the spending habits that eat away at your bank balance every month, there are many benefits to learning practical and easy ways to save your money.

Keep reading for some money-saving tips, or jump to the section that’s most helpful for you.

1. Create a budget

When learning how to save money, assess how much you really have and where that money is going. Think about using the 50/30/20 rule to help you create a budget.

The 50/30/20 rule is when you save…

- 50% of your income for essentials like rent and food

- 30% of your income for extras like entertainment

- 20% of your income for savings and debt, like accounts you owe or that help with emergencies and retirement

2. Track your spending

You may be surprised to learn where your money is actually going every week. By keeping a record of what you spend, you can see how small expenses take away from your monthly savings.

A great way to track your spending and start budgeting is with a budgeting app like Mint, which puts all your accounts in one place to help you navigate your spending and saving habits with ease.

3. Make detailed budgeting plans

Breaking your long-term goals into smaller, more manageable milestones can help you save money more effectively.

For example, if your overall goal is to save $1,200 a year, start with smaller goals of $100 every month or even $25 every week. A detailed plan can help you get on track and make progress toward your bigger goal.

4. Try envelope budgeting

Envelope budgeting can help you save money by limiting your spending to divided cash allowances. This method makes you more aware of your spending and encourages you not to spend too much of your money in one area.

5. Use a budgeting app

Using a budgeting app can help you not only with saving money but also with staying on track with spending goals, expenses, and budgets. It can be an easy way to stay updated on how you’re doing and get more familiar with your spending habits.

6. Carpool to work or school

An easy way to save money on commuting costs is by sharing the ride. If you have kids, enlisting nearby parents to help lighten the burden of the school drop-off lines is a great way for everybody to save money on gas every month.

7. Audit your subscriptions

A survey from May 2022 found that 42% of people forgot about subscriptions they were still paying for but no longer using. Take a look at your monthly bank statements to audit your subscription services and cancel the ones that you no longer need.

8. Switch to a cheaper phone plan

When it comes to your phone plan, track how much data you’re actually using and stop paying for services you don’t need. This will allow you to save more money every month on your phone bill.

9. Lower your utility bills

Evaluate whether or not you’re being as efficient as possible with your utilities. Is your air conditioning always running in the background? What about an upright fan that you use for both cooling and white noise? Unplugging your small appliances while not in use is a great way to reduce your electricity bill.

10. Consider canceling your gym membership

How to save money If you get a lot of value out of your gym membership, this may not apply. But if your membership is costly, you might want to reevaluate what you can do at home or outdoors that’s just as effective.

Some money-saving techniques for those who want to prioritize their health on a budget include…

-

Watching YouTube tutorials for ideas about home workouts

-

Going for a walk or run in your neighborhood

-

Swimming laps at your community pool

-

Joining a local amateur sports league

-

Playing workout video games

-

Adding workout plans to lifestyle apps

11. Plan your groceries

Making a list of the food you want to eat for the week and the groceries you need can help you save money. Sticking to your list can help you avoid extra purchases and even help reduce your food waste in the meantime.

Use Credit Karma’s budget calculator if you need help determining a reasonable budget for your trips to the store.

12. Use coupons

Coupons are widely available and can be a convenient and easy way to save money when shopping. They can also help you get more bang for your buck. Often, coupons can get you a free item, a cheap bundle, or even a discounted subscription plan.

Great places to find coupons include…

- Newspapers and magazines

- Grocery store ads

- Company websites

- Email subscriptions

- Website browsers and apps

13. Take advantage of seasonal sales

Demand for certain big-ticket items can fluctuate by season. Consider timing your big purchases to rake in the savings. For example, October to December can be a great time to buy a car because dealerships want to meet end-of-year quotas. Their desire to sell a car can be beneficial to your purchasing power.

14. Designate no-spend days

Challenge yourself and your family to go one day a week without buying anything, from your morning coffee to a movie ticket. You may learn to save better by reducing your spending and becoming more aware of how frequently you make small purchases that aren’t necessary.

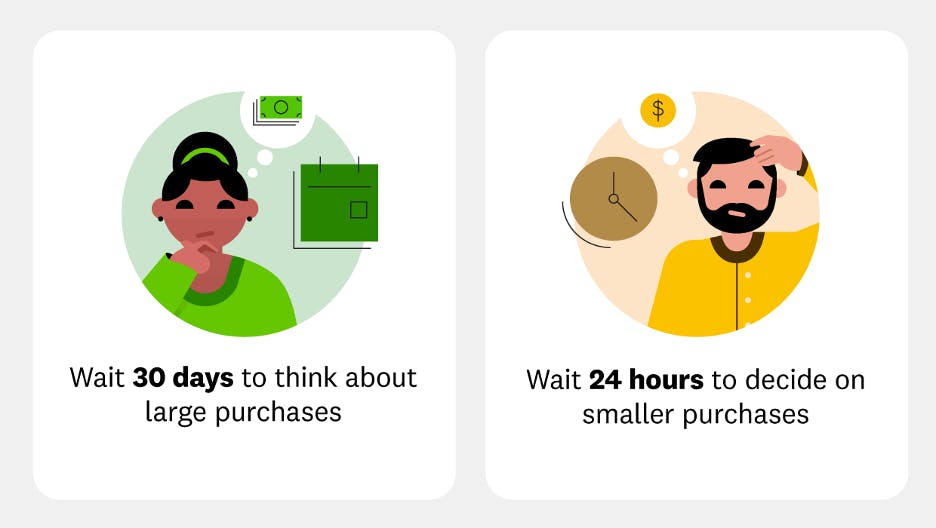

15. Use the 30-day rule

When you want to make a large purchase, think about it first. Consider what it is and how much it costs, and if you feel that it’s still important after, say, 30 days, maybe you’ll feel more confident purchasing it.

It’s also important to remember that dipping into your savings for a big purchase can deter your long-term goals. If it’s not an emergency, consider saving up additional funds for the purchase first.

16. Try the 24-hour rule

For less-expensive purchases, the 24-hour rule can give you the same pause the 30-day rule does for big-ticket items. Consider waiting an entire day before buying a small, non-essential item … You may find it’s not worth it after all.

17. Build an emergency fund

Some experts recommend setting aside about six months’ worth of living expenses in case of emergencies. Save your money to create a cushion that can help you avoid going into debt if you ever lose your job or have to pay unforeseen medical expenses.

If the idea of an emergency fund overwhelms you, start with our savings calculator to get you started on the right foot. The last thing you want is to be unprepared.

18. Create a savings account for retirement

When it comes to saving for your retirement, some experts recommend putting away at least 15% of your income each year. Determine how much you’ll need and break that down by paycheck to set aside a specific amount of money that’ll help you hit your goals over time.

19. Use a high-yield savings account

High-yield savings accounts—like Credit Karma Money™ Save — can help you grow your savings without even thinking about it. All you need to do is deposit your earnings into an account and let interest do the work for you. The national average rate as of February 2023 is.35%, but your returns will depend on the account you use.

20. Automate savings transfers

Automating deposits into your savings account can help you save money more easily—and without thinking about it. There are several ways you can create automatic savings account deposits, and each bank offers a different solution. Here are a few examples.

- Some money-saving apps allow users to save spare change from their purchases.

- Certain banks will round up purchases to the nearest dollar and deposit that change into a savings account.

- There are also programs that automatically move money from your checking to your savings account for every debit card purchase you make.

Automated savings programs help you invest in yourself and your future.

21. Consider investment accounts

While assets like stocks, mutual funds, and certificates of deposit shouldn’t be your only form of savings, they have the potential to provide attractive returns on your investment over time.

Before making any riskier investment moves, be sure to thoroughly research your options, or if you can, talk to a professional financial adviser.

22. Refinance your mortgage

You may find that you can save money on your monthly mortgage payment by taking advantage of a better mortgage rate—something that could add up to thousands of dollars over time.

Here are a few steps on how to refinance your mortgage.

- Check your existing APR to see if it’s higher than the current market rates

- Double-check your credit scores

- Shop around for different mortgage lenders

- Use a mortgage calculator to crunch the numbers

- Complete a refinancing application

- Choose your lender, prepare for closing and pay fees

Remember to do the math to ensure a refi makes financial sense for you, and consider talking to a financial adviser if you’d like a professional opinion.

More tips to help you save money

Want more insight on how to save money in specific situations? Whether you need to spend less money in general, want to save money with your family, or need ideas on bundling entertainment, these tips can help you in your saving journey.

- Avoid eating out. Eating out can be a great way to save money every month. Plus, there are plenty of ways to make it fun and appealing.

- Opt for water. If you do eat out, you may still be able to save some money by ordering water rather than a soda or alcoholic beverage.

- Buy generic. A great way to save more while shopping is to not allow name brands to influence you. If the quality of the generic item is the same, you don’t necessarily need to buy the name brand.

- Buy used items. If you love money-saving deals, local thrift stores and online auction sites and marketplaces can offer everything from clothes to electronics at stellar discounts. You can get slightly used, high-quality items at a fraction of the cost of their newer counterparts.

- Use public transportation. Try replacing your drive to work one day a week. You’ll be able to get other things done on the bus or train while saving money on gas and avoiding some wear and tear on your car.

- Check your insurance rates. Car insurance companies regularly raise their rates, so you may save some money by shopping around for lower prices every so often. Shop around for auto insurance quotes to see if you can get a better deal.

- Ask for discounts. Some facilities offer discounts for things like being a senior, an AAA member, or a student. You never know what you can save if you don’t ask!

- Unsubscribe from marketing emails. Sometimes marketing emails can lead to unplanned purchases. Unsubscribing can help prevent you from being tempted.

- Save your tax refunds. Rather than spending your tax refunds, set them aside in your savings account.

How to save money on entertainment

- Get a library card. Libraries don’t only offer books; you can also rent movies, audiobooks, comics, and games and attend free events like readings for kids on a regular basis.

- Find free events in your area. Browse social media to find free events in and around your area. You may find several family-friendly events or concerts that won’t cost you a penny.

- Cut the cable. Cutting ties with cable TV and opting for internet-only streaming services can save you a pretty penny.

- Watch matinees. Many theaters offer discounted matinee tickets for movie showings in the daytime versus the evening.

- Rent movies. You can save money by waiting for movies to hit the rental market instead of seeing them in theaters. While movie tickets cost $9.57 on average as of 2021, a rental can cost just a few dollars, and streamed movies might only cost you the monthly membership price.

How to save money

- Have family game nights. Save money with a night in—play a board game or video game with your family on a designated night each week. You’ll save money on entertainment costs and bond with each other too.

- Double your meal recipes. When you cook, it might be smart to buy groceries in bulk and double your recipes. You can spend less time cooking throughout the week and save more money while you’re at it.

- Spend time outside. With the great outdoors almost always free to enjoy, there are tons of low-cost or cost-free activities. Try packing a basket and going on a nice family picnic in the park.

- Enjoy a staycation. Rather than spending money on expensive plane tickets and hotels, see what popular sights or experiences await you in your backyard as a tourist in your own city.

- Have a family yard sale. By selling old items around the house you no longer need, you may be able to raise some vacation or night-out funds without eating into your cash on hand.

- Create a gift limit. If you have several members in your family, gift-giving during holidays or birthdays can become expensive. Set a price limit for family gifts to save some money.

Homeowner money-saving tips

- Close blinds and curtains. Closing your blinds and curtains when you’re not home is a good way to keep your house cool and lower your air conditioning usage.

- Be conscious of your water usage. Taking shorter showers can lower utility costs. You can also turn off the faucet when you brush your teeth and use low-water settings on your dishwasher and washing machines to help lower your water bill.

- Lower your water heater temperature. By lowering the temperature of your water heater to 120°F, you can save on gas and heating utility bills.

- Start weatherproofing. Use caulk to mend holes and cracks in your walls. Identify windowpanes and door frames that have drafts and fill them in. Place plastic wrap around windows to keep the heat from escaping in the winter.

- DIY home repairs. You may be able to save a good chunk of change by DIYing home repairs rather than paying a professional—if it’s something you can confidently handle. A professional is probably still a good idea if you’re not knowledgeable about the fix.

- DIY cleaners. Along the same lines, you may save money by forgoing store-bought cleaners to make your own. You may be surprised at how far one bottle of white vinegar and some lemon can get you! Do your research and see what you can make at home that’s just as effective.

- Use half as much laundry detergent. Nowadays, most detergents are concentrated. By cutting down on the amount of detergent you use, you can make your product stretch longer and ultimately spend less money on it.

- Put your bills on autopay. This can help ensure your mortgage, insurance, or utility bills are paid on time and in full, so you can avoid possible late payment fees, which can also harm your credit.

- Avoid paper products. One way you can save some money is by choosing washable dishrags and napkins over paper towels. As a bonus, you’ll also contribute to lower demand for paper products.